10-06-2021

10-06-2021

Islamic insurance market growth to be driven by compulsory health cover – Moody’s

Insurance Alertss

Insurance AlertssIslamic insurance market growth to be driven by compulsory health cover – Moody’s

DUBAI: The Islamic insurance market will continue to grow at current levels in the coming two to three years as more GCC, southeast Asian and African countries introduce mandatory health care, according to Moody’s Investors Service.

Takaful growth will be helped by relatively low levels of insurance penetration and large Muslim populations in these regions, Moody’s said in a report.

Takaful accounted for an average 29 percent of total insurance premiums in its largest markets at the end of last year, up from 27 percent in 2016, while penetration of all insurance products is in the low to mid-single digits compared with 11.2 percent in a mature market, such as North America, Moody’s said.

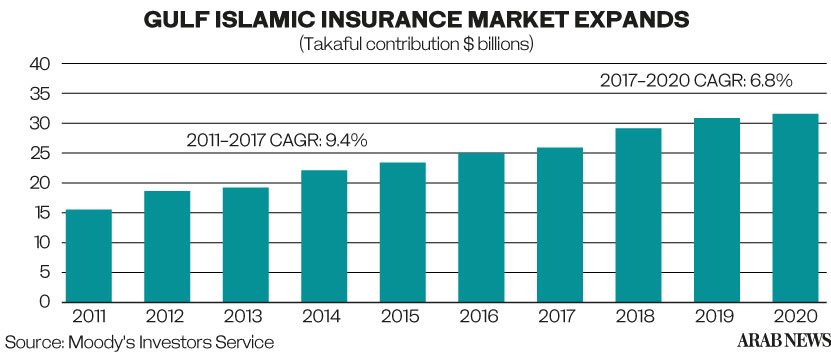

Islamic insurance premiums grew at a compound annual rate of 6.8 percent between 2017 and 2020, it said.

“The recent adoption of risk-based capital regulation in key takaful markets, and takaful insurers’ continued embrace of digitalization, are further positive factors,” Mohammed Ali Londe, a senior analyst at Moody’s, wrote in the report.

Compulsory medical insurance was introduced over the past four years in Oman, Qatar, Saudi Arabia and Kuwait, while mandatory motor insurance was implemented in Saudi Arabia, the biggest takaful market, this year.

Health premiums in Malaysia grew 25 percent in 2019 after the country’s National Health Protection Scheme was introduced, Moody’s said. Egypt is in the process of phasing in compulsory health cover.

Source: Arab News