02-07-2021

02-07-2021

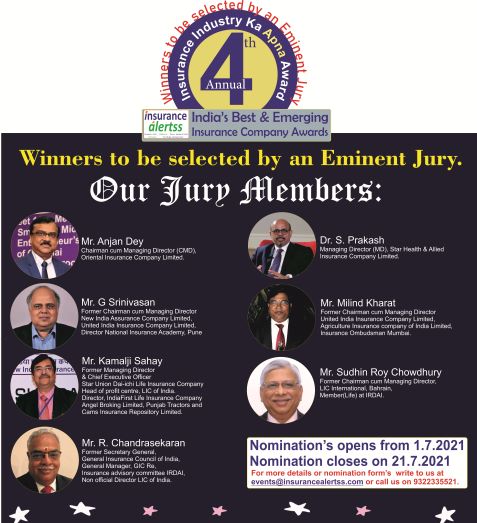

Firm sues broker for neglecting to effect business interruption cover

Insurance Alertss

Insurance AlertssFirm sues broker for neglecting to effect business interruption cover

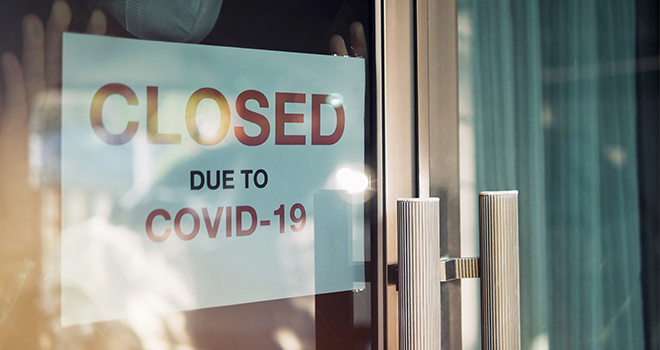

A Cape Argus article dated 24 June 2021 relates the details of a short-term insurance client who is suing his broker for negligence in failing to effect insurance against business interruption, leading to a loss of R4.7 million.

The client runs an adventure business and was unable to operate and generate an income after lockdown in March 2020.

A TSITSIKAMA adventure business, Untouched Adventures, has filed notice to sue its insurance broker, PSG Konsult Limited, in the Western Cape High Court for R4.7 million in a case where the broker is accused of negligence in failing to insure the firm’s business against interruption cover that would have been triggered by the Covid-19 lockdown last year.

In the application to sue, the company said the broker ”had a duty to use reasonable care to see that Untouched Adventures was insured for business interruption,” as had been requested when the insurance was acquired. The owner of the company, Marthinus van der Westhuizen said when he got the insurance he was under the impression that the broker would call his attention to any endorsements, exclusions, conditions or burdens that were significant and that might affect the extent of the cover in relation to the premises and business.

Believing his business was covered for the loss caused by the Covid-19 pandemic, as per his insurance policy taken in June 2019, Van der Westhuizen called his broker to see if the business interruption clause of the insurance policy could be triggered. During the call he was told the company hadn’t ticked the business interruption cover option and so he was not covered. Van der Westhuizen’s attorney, Menko Hoeksema, argued the broker and/or its employees were negligent.

He said consequently, they breached the duty of care, and as a result his client suffered damages of R4 709.250. In their answering affidavit, the brokers’ attorney, Stéfan de Swardt, said his clients opposed the suit because it was vague and embarrassing and would not stand up in court. De Swardt said Untouched Adventures accepted a quotation for insurance and that a policy was issued following the acceptance. They also argued that the policy did cover business interruption, just not for “contagious or infectious notifiable disease”.

From the report it is not clear whether this case was referred to the short-term Ombud first. With the amount involved, it would also not have benefitted the complainant to approach the FAIS Ombud as the latter has restrictions in terms of how much it can award in compensation should negligence be proven. It is to be hoped that the adviser complied with all the FAIS requirements in terms of the record keeping which should exonerate him from negligence.

Material terms and conditions

In a letter, rejecting a claim for losses resulting from business interruption as a result of an infectious disease, an insurer stated:

Our investigation revealed that that if no lockdown had been imposed, the insured would not have been prevented from receiving guests, and guests would not have been prevented from coming to the insured’s guesthouse. It was in other words the lockdown that was the cause of the cancellations concerned. For the cover to apply, the business interruption must in other words have been caused directly by some individual at the insured’s guesthouse becoming infected, or someone working at the guesthouse, or a would-be guest, coming into contact with an infected person within the 50 km radius.

It took 13 judges to convince insurers that their interpretation was wrong. How could the broker in this case reasonably have foreseen a possible pandemic? Business interruption by causes other than fire and the like are so rare that some insurers did not even charge a premium for it.

This again brings us to the point where we have to ask: How does an adviser decide which material terms need to be brought to the attention of the client at the time of contracting? Sure, exclusion clauses and the like need to be pointed out, but something as obscure as this was certainly not a material condition on which to enlighten the client.

In hindsight, everyone has 20/20 vision. Perhaps advisers should invest in crystal balls to make sure they cover all the bases.

Source: Moonstone