09-07-2021

09-07-2021

Insurance sector attracts 40% of FPI flows worth $2.35 bn in June

Insurance Alertss

Insurance AlertssInsurance sector attracts 40% of FPI flows worth $2.35 bn in June

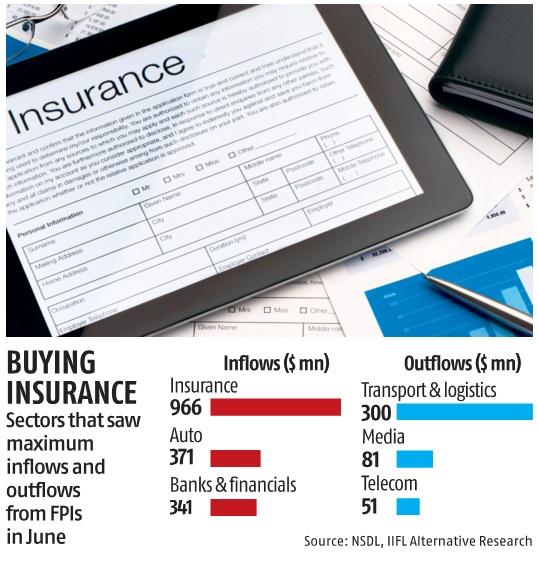

The insurance stocks attracted more than 40 per cent of foreign portfolio investor (FPI) flows into the domestic market in June. Overseas investors pumped in a total of $2.35 billion last month, of which $0.97 billion got invested in insurance companies, says a note by IIFL Securities.

After insurance, the automobile and banks & financial stocks the maximum inflows at $371 million and $341 million respectively. Insurance isn’t a big sector by weight, accounting for just 2.5 per cent of FPI corpus. In comparison, nearly a third of FPI investments in the country are in the banking and financial sector.

Experts say the unusually high investment in the insurance sector was on account of large block trade in HDFC Life Insurance Company. In June, Standard Life divested 5 per cent stake in HDFC Life Insurance Company to raise about Rs 6,784 crore. Market watchers say the share sale saw healthy demand from FPIs.

“Insurance was one of the key beneficiaries of the inflows with block deals driving a major part of it. Even after adjusting for the value of blocks, the net inflow was pretty encouraging,” said Sriram Velayudhan, Vice President at IIFL Securities in a note.

He added that the FTSE rebalancing led to an increase in FPI flows in the auto sector.

Meanwhile, stocks in the transport & logistics sector saw maximum FPI outflows at $300 million. This was followed by the media and telecom sector, which saw relatively subdued outflows at $81 million and $51 million, respectively, in June.

In terms of sectoral weightage, IT and FMCG saw 90 basis points (bps) and 63 bps increase in FPI weightage to 14.02 per cent and 12.32 per cent respectively. The banking and financial sector saw 85 bps drop in FPI weightage to 32.01, shows analysis done by IIFL Securities.

Source: Business Standard